SEBI eases buy-back norm, reduces turnaround time to raise funds

23-April-2020

To relax the conditions for raising funds from the securities market amidst the financial disturbance caused due to the Covid-19 pandemic, regulator SEBI has decided to ease buy-back regulations.

In financial parlance, a buy-back refers to repurchase of the company's stocks from the existing shareholders. This process is either undertaken through the open market or the tender offer route.

The SEBI has decided to ease norms governing buy-back. At present, these regulations restrict companies from raising further capital for a period of one year from the expiry of buy-back period, except in discharge of their subsisting obligations.

"It has been represented that the said period of one year may be reduced to six months, which would be in line with section 68(8) of the Companies Act, 2013," the regulator said in a circular.

"To enable relatively quicker access to capital, it has been decided to temporarily relax the period of restriction... of the buy-back regulations. This relaxation will be applicable till December 31, 2020."

The relaxation comes into force with immediate effect, it said.

A buy-back generally improves return on equity and earnings per share by reducing the equity base.

Furthermore, it gives an option to the shareholders to get cash in lieu of equity shares or to increase their percentage shareholding in the company following the offer, without additional investment. IANS

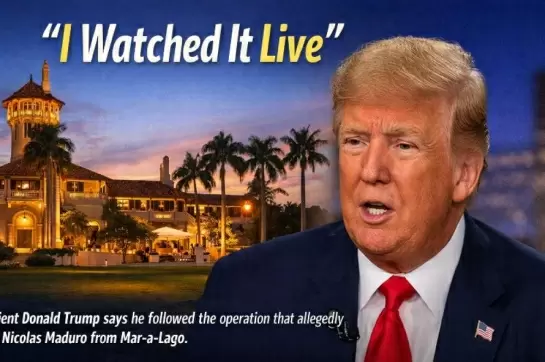

Venezuelan President, Wife Captured After Strikes On Caracas, Claims Trump

Bengaluru to Get Third-Largest Park After Lalbagh, Cubbon; Basavanna Biodiversity Park Approved

Nation Remembers Tamil Queen Veeramangai Rani Velu Nachiyar Who Fought The British

Treat Gig Workers As Human Beings, Not Disposable Data Points: Raghav Chadha

Missing BJP Leader Found Dead in Pond After Five Days in East Midnapore