Kerala records huge leaks in gold tax collection

04-March-2020

The Congress in Kerala assembly on Wednesday cried foul over the alleged nexus between the tax department of the Kerala government and the traders selling gold.

Senior Congress legislator V.D. Sateeshan sought adjournment motion to discuss this nexus when he pointed out that the Finance Minister Thomas Issac is feigning ignorance and allowing the traders to have a free run.

"During the financial year 2016-17, when VAT was in force, the total taxes from gold was Rs 200 crore and today under GST what has been raised is a mere Rs 300 crore. Under VAT regime the tax on gold was 1.25 per cent, while its 3 per cent now. Added to the increase in rates, there has been a 50 per cent hike in the price of gold, but what came into government coffers was a mere increase of Rs 100 crore. This clearly shows that there is an unholy alliance," said Sateeshan.

"Figures have shown that 30 per cent of the world trade in gold takes place in India, of which Kerala leads the rest of the country. Studies have shown that the per capita monthly expenditure on gold in Kerala stands at Rs 208 and next comes Goa, where it is just Rs 34. This itself shows the volume of trade in gold in our state and just see a mere Rs 300 crore has been collected as taxes," added Sateeshan.

According to a study conducted by economist Mary George, the total taxes that can be collected from gold sales annually is as high as Rs 18,000 crore, but only a miniscule of it is collected.

But Issac however said the biggest problem that the taxes department faces is lack of rules and regulations.

"The Customs and Central Excise have enormous powers to raid the gold traders but such powers are not there with the state government GST officials. That's a major lacuna for effective surveillance. We have raised these issues in the GST Council. Moreover, we have now taken possession of the accounts of 75 gold traders in the state and has handed over to C-DAC for inspection. We have also decided to set up a cyber laboratory for inspection under the taxes department. We are in the process of plugging the leaks in tax collection and it has already begun," said Issac.

Leader of opposition Ramesh Chennithala said that according to the figures, unaccounted annual sales of gold in the state is around Rs two lakh crore, including the widespread smuggling that takes place.

"At least a minimum of Rs 6000 crore can alone be raised through taxes in gold sales and the sad thing is despite the big talks given by Issac, he has raised just Rs 300 crore. All the state's financial crunch could be erased and this is what is called prudent fiscal management. You are not doing your job the way it should be done," said Chennithala and walked out of the house, protesting the Speaker's decision not to allow a discussion on this. IANS

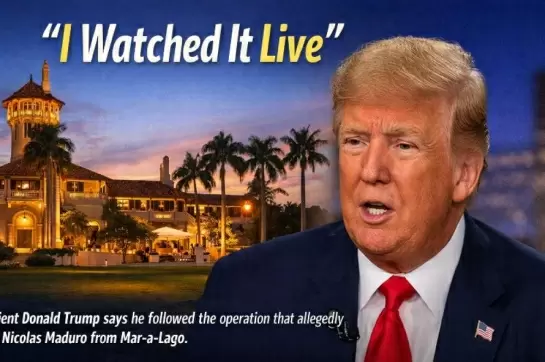

Venezuelan President, Wife Captured After Strikes On Caracas, Claims Trump

Bengaluru to Get Third-Largest Park After Lalbagh, Cubbon; Basavanna Biodiversity Park Approved

Nation Remembers Tamil Queen Veeramangai Rani Velu Nachiyar Who Fought The British

Treat Gig Workers As Human Beings, Not Disposable Data Points: Raghav Chadha

Missing BJP Leader Found Dead in Pond After Five Days in East Midnapore