No let-up in sanction of GST refunds: FinMin

08-November-2018

Allaying fears of growing pendency of Goods and Services Tax (GST) refunds, the government on Thursday said more than 93 per cent of the claims have been sanctioned by October-end and the disposal rate is consistently improving.

"Concerns are being raised about growing pendency of GST refunds. Exporters are reassured that there is no let-up in the sanction of GST refunds. The disposal rate is consistently improving month-on-month," the Finance Ministry said in a statement.

GST refunds to the tune of Rs 82,775 crore were disposed of by the Central Board of Indirect Taxes and Customs (CBIC) and state authorities out of the total refund claims of Rs 88,175 crore received so far, as on October 31.

"Thus, the disposal rate of 93.8 per cent has been achieved as on October 31, 2018," it said.

The Ministry said pending refund claims amounting to Rs 5,400 crore are being expeditiously processed, so as to provide relief to eligible exporters. Refund claims without any deficiencies are being cleared efficiently, it said.

In case of integrated GST (IGST) refunds, 93.27 per cent or Rs 42,935 crore of the total IGST refund claims of Rs 46,032 crore transmitted to Customs from GSTN have been disposed of.

"The remaining claims amounting to Rs 3,096 crores are held up on account of various deficiencies which have been communicated to exporters for remedial action," it said.

Further, in case of Input Tax Credit (ITC) refund claims, out of the total Rs 42,145 crore, the pendency as on October 31 is Rs 159 crore with the Centre and Rs 2,146 crore with states.

Provisional or final order has been issued in case of refunds amounting to Rs 34,602 crore. In claims amounting to Rs 5,239 crore, deficiency memos have been issued by respective GST authorities, it said.

The Ministry added efforts are being made continuously to clear all the pending refund claims, where ever requisite information is provided and found eligible.

It sought co-operation of the exporter community to ensure that they respond to the deficiency memos and errors communicated by Centre and state GST as well as customs authorities and also exercise due diligence while filing returns and shipping bills.-IANS

PM Modi Applauds Maiden Voyage of Stitched-Ship INSV Kaundinya From Porbandar to Oman

Unnao Rape Case: 'Don't Let Hate Bury The Truth', Pleads Sengar's Daughter In Viral Open Letter

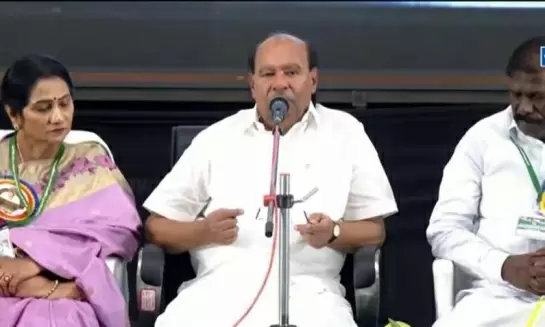

PMK Leader Dr Ramadoss Says Alliance Decision Soon, Launches Sharp Attack On Son Anbumani

Four Juveniles Held for Brutal Sickle Attack on Man Near Tiruttani Railway Station

Bangladesh Army Watches As Yunus Administration Grapples With Violence, Chaos